THIENEL LAW BLOG

The Definitive Guide to Business Valuation

There are numerous methods for valuing a business. Most valuation methods use a combination of factors to determine the current value of the business, such as assets, revenue, debts, operating expenses, goodwill, market value, and projections. The business valuation method used for a specific company depends on several factors, such as the type of business being valued, the size of the business, and the reason for the valuation. Choosing the best valuation process to use is the first step in the business valuation process.

Eight Government Contract Winning Strategies for Women-Owned Business

Women who own small businesses have more opportunities than ever before to obtain lucrative federal government contracts. Many opportunities for government contracts are specifically designed for women who own small businesses. Here are eight strategies that can help women win the government contracts they desire for their small businesses.

How to Ensure Your Assets are Properly Titled for Your Estate Plan

Through a will, you can appoint a guardian for your minor children and set up a testamentary trust for your children. A will’s primary purpose in an estate plan is to ensure your property is distributed after your death in accordance with your wishes. Many individuals who have a will might assume that they need not take any further steps to safeguard their estate plans. However, some property does not pass through your estate. It may pass directly to a beneficiary or a joint owner.

Five Things You’ll Want to Know About the 199A Deduction in 2020

The Tax Cuts and Jobs Act (TCJA) included a provision to help small business owners reduce their tax liability. The new deduction, commonly called the Section 199A deduction, allows some small business owners to deduct up to 20 percent of their qualified business income from their taxable income. In other words, small business owners have the potential for saving thousands of dollars in taxes by lowering their taxable income through a Section 199A deduction.

[VIDEO] Tax 101 – Four Ways to Defeat IRS Penalties

Nobody likes paying taxes, especially when the IRS heaps on penalties for an honest mistake. Watch this video to discover a few tips on getting the IRS to back down on those penalties. Have tax questions? Talk with Maryland tax attorney, Steve Thienel.

The Ultimate Guide to Estate-Planning for Single Parents [2020 Edition]

Single parents have unique challenges when developing an estate plan. In most cases, their overriding goal is to provide for the care and upkeep of their children should they pass away while their children are still minors. With that in mind, below are three essential estate planning questions that all single parents ask themselves when they begin developing an estate plan.

Does Your Estate Plan Make These 5 Big Tax Mistakes?

Estate planning has numerous benefits for you and your loved ones. With a comprehensive estate plan, you can protect your property and your heirs. One of the common reasons many people create estate plans is to address tax matters. However, without the assistance of an experienced Maryland estate-planning attorney, an individual could make big tax mistakes that are costly for those the person is trying to protect.

[VIDEO] Business 101: Five Contract Tips Every Business Owner Should Know

As a business owner, understanding contracts is crucial to your livelihood. This short video will help you better understand the terms that govern your relationships. If you have questions about a contract matter, talk with a business attorney. Working with a fractional general counsel can make the contracting process more cost-effective for your business.

Do Small Businesses Need NDAs?

A nondisclosure agreement or NDA creates a legally binding, confidential relationship between your company and another party. NDAs are also referred to as confidentiality agreements because they require another party to maintain the secrecy of information disclosed in confidence by the other party. With an NDA, you can protect sensitive and valuable information related to your small business.

Should You Insure Your Business?

Purchasing business insurance is like paying for licenses and permits for your business. It is something you know you need. It is also a cost of doing business, but it is an expense you would rather do without. Without insurance coverage, a natural disaster, personal injury lawsuit, theft, workplace injury, or other catastrophe could cause devastating losses for the company. Many companies, especially small businesses, do not have the liquid assets to cover such losses. Insurance is the safety net that can help a business survive certain events and legal issues.

[2021 UPDATE] Digital Assets - Erasing Your Digital Footprint When You Die

Managing your digital afterlife has become an important part of estate planning for many individuals. In addition to planning for transferring digital assets, many individuals are also concerned about their digital footprint after their death. Experienced Maryland-estate planning attorney should be able to discuss handling digital assets and your digital footprint in relation to your estate planning goals.

Taxes for AirBnB Rental Properties

Owners who list their Maryland property on AirBnB should know a major change in the tax laws for short-term occupancy taxes. The change took effect on June 1, 2019. AirBnB has noted the tax on its website. Many property owners fear that the mandatory occupancy tax will reduce the number of guests who book their property, but owners of hotels and other businesses already subject to state occupancy taxes were for the change.

Avoid These Expensive Mistakes on Your Payroll Taxes

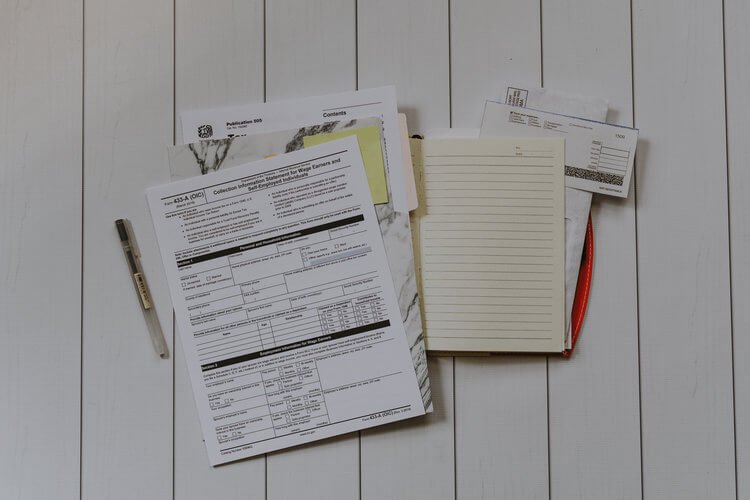

Issuing a paycheck is not as simple as writing, signing, and handing a check to an employee. The federal and state government expect employers to withhold certain taxes from an employee’s check and submit those taxes, along with employer’s payroll taxes, to the correct taxing authority by certain deadlines. Failing to report payroll properly and pay tax authorities could cause costly fines and penalties for employers.

How Will my Cryptocurrency Sales Affect my Taxes?

The IRS views digital currency as property. Therefore, the applicable tax code for cryptocurrency is typically the portion of the code that relates to capital gains or losses. However, some transactions involving digital currency may be treated as income for the owner. Now that Bitcoin and other forms of digital currency have gained in popularity, and increased substantially in value, the IRS is interested in ensuring that taxpayers report cryptocurrency correctly.

[Video] Tax 101 - Five Tips for Making Tax Time Easier Next Year

Tax Attorney Steve Thienel discusses time-honored tactics for reducing stress around tax time.

11 Contract Negotiation Strategies to Get You What You Really Want in Business

Business negotiations can be tricky. As parties go back and forth to reach an agreement, the parties are struggling for leverage and favorable terms. In most negotiations, both parties compromise on some issues. Rarely do all parties walk away from business negotiations with everything that they desired when they began the process. Even though negotiation skills are important, it is also important to remember that there is a legal aspect of business negotiations.

9 Things to Consider Before You Sell Your Business

Are you ready to sell your business? You have worked hard to build your company, but it may be time to let it go. Whether you are retiring or moving on to another venture, there are many things to consider before you begin the process of marketing and selling your business. Preparing in advance is the key to maximizing the value you receive when you sell your company.

4 Estate Planning Secrets of the Wealthy That You Can Use Too

Accumulating wealth and protecting wealth are two estate planning goals shared by most individuals, regardless of the size of their estate. If you are searching for ways to increase your estate to leave a substantial legacy to your heirs, look at some of the estate planning secrets wealthy individuals use as they develop and execute a comprehensive estate plan.

[VIDEO] Business 101 - Choosing a Business Entity

One of the most important considerations you will have as a start-up is choosing a business entity. This choice affects your tax liability, your ability to sell shares, and may even impact your ability to receive funding.

When Do I Need to File a Non-resident Tax Return?

Individuals who work or live in Maryland are typically subject to state taxes based on their residency status. Therefore, your residency status can have a significant impact on whether you owe state income taxes. If Maryland demands you file a tax return and pay state income taxes even though you were not a resident, contact a Maryland tax attorney to discuss your options for challenging the state’s claim of residency.

![[VIDEO] Tax 101 – Four Ways to Defeat IRS Penalties](https://images.squarespace-cdn.com/content/v1/639b5b2c4098ba4df6e6dc92/1673043948366-G191ZMNJQAVHRJYMHFTU/2%2BTaxes%2B101%2BVideo%2BImage.png)

![The Ultimate Guide to Estate-Planning for Single Parents [2020 Edition]](https://images.squarespace-cdn.com/content/v1/639b5b2c4098ba4df6e6dc92/1673043757055-8HUYBVIHIYZC387KJCBF/The%2BUltimate%2BGuide%2Bto%2BEstate-Planning%2Bfor%2BSingle%2BParents%2B%5B2020%2BEdition%5D.png)

![[VIDEO] Business 101: Five Contract Tips Every Business Owner Should Know](https://images.squarespace-cdn.com/content/v1/639b5b2c4098ba4df6e6dc92/1673045128436-V5WRSOT8EWIHEO9N1WNV/screenshot-www.dropbox.com-2019.09.24-17_09_03.png)

![[2021 UPDATE] Digital Assets - Erasing Your Digital Footprint When You Die](https://images.squarespace-cdn.com/content/v1/639b5b2c4098ba4df6e6dc92/1673047541501-U19E4D9Z0RJV4IMAYN34/Digital-Assets-Estate-Planning.png)

![[Video] Tax 101 - Five Tips for Making Tax Time Easier Next Year](https://images.squarespace-cdn.com/content/v1/639b5b2c4098ba4df6e6dc92/1673049831533-ZMKCVDJBTAPNCWD3W05P/image-asset+%281%29.jpeg)

![[VIDEO] Business 101 - Choosing a Business Entity](https://images.squarespace-cdn.com/content/v1/639b5b2c4098ba4df6e6dc92/1673050514813-Q7IUR5QXEM9OV7C81216/7%2B19%2BBusiness%2B101%2BChoosing%2Ba%2BBusiness%2BEntity.png)